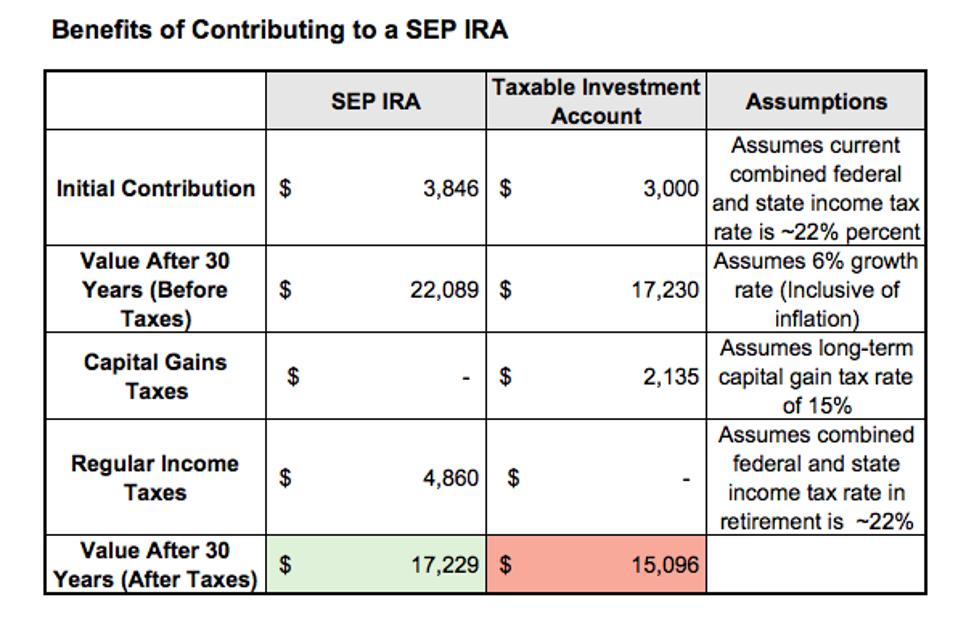

Last updated: may 5, 2023 at 11:04 am when it comes to saving for retirement, there’s no one-size-fits-all solution. Instead, we have many options in today’s world, each with unique features and benefits. Two popular choices among these are simplified employee pension (sep) iras and roth iras. As you plan for your financial future, it’s essential to understand the differences between these two retirement savings vehicles and determine which one best suits your needs. In this comparison, we’ll compare sep and roth iras, discussing their advantages, limitations, and eligibility requirements to help you make an informed decision. Both roth and traditional iras come with contribution limits set by the irs for retirement plans. From 2021, the maximum annual contribution to a plan for the majority of individuals will be $6,600 (or $7,000 for those who are 50 or over). These contributions are essential to build retirement savings and to avoid excessive contributions. The other hand, sep iras allow greater retirement plan contributions limitations determined by business income. Businesses can give up to 25% of salary of $58,000 (whichever lower) in 2021 to their retirement savings. http://y1e.s3-website.ap-northeast-1.amazonaws.com/401kgoldira/Retirement-Plans/Choosing-a-SEP-IRA-or-Roth-IRA-in-2023.html Traditional vs. Roth vs. SEP IRA: An Overview Officially, an

Gold IRA Guide

Gold IRA Investment Guide

A 401(k) plan has become one of the most sought-after retirement savings vehicles in America due to its many advantages, making it one of the go-to plans for many Americans looking for financial security during retirement. Let's examine some of its primary advantages as well as their tax ramifications and employee contributions value as we explore five of the frequently asked questions about them. Advantages of 401(k) Retirement Plans Pre-Tax Contributions: One of the key advantages of traditional 401(k) plans is being able to contribute on a tax-deferred basis - meaning any money contributed reduces taxable income for that year and lowers current taxes due. Tax-Deferred Growth: Your 401(k) investments grow tax-deferred until retirement withdrawals start being taken out; this tax-deferred growth can significantly bolster savings over the long haul. Employer Match: Many employers provide matching contributions up to a set percentage of your salary in your 401(k). This effectively provides free money that will bolster your retirement savings substantially. High Contribution Limits: As of 2021, individuals under 50 can make contributions of up to $19,500 yearly while those 50 and over may contribute $26,000 or more per year in their 401(k). This significantly higher

If you are a professional looking to diversify your retirement savings, investing in gold can be a rewarding choice. This guide will walk you through the process of moving your 401K to gold without incurring penalties. Understand Why Gold Is a Good Investment Hedge Against Inflation Gold tends to retain its value even during economic uncertainties, making it an excellent hedge against inflation. Portfolio Diversification Adding gold to your portfolio can provide a balance, as it often performs well when other investments are faltering. Determine Eligibility Before you proceed, it's important to confirm whether you're eligible for a 401K rollover into a gold IRA. Check the Type of Retirement Plan Not all retirement plans allow for rollovers into a gold IRA . Generally, 401Ks, 403bs, 457s, TSPs, and traditional IRAs permit such transfers. Consult a Financial Advisor To be sure, consult with your financial advisor or plan provider about the possibility and specifics of such a rollover. Choose a Trusted Gold IRA Company Research Companies Look for a company with a strong reputation, positive customer reviews, and transparent fee structures. Compare Services and Fees

As a savvy investor, you might be thinking about diversifying your portfolio, and looking for ways to shield your hard-earned assets from the effects of inflation, economic uncertainty and geopolitical risk. One option you can think about is to invest in gold via an Gold IRA. If you're unfamiliar with the world of investment in precious metals, or are unfamiliar about the tax regulations and regulations that govern the creation of the Gold IRA, you may require some help. This is where the Gold IRA Rollover Guide comes to your aid. The guide is going to explain all you should be aware of when investing in the Gold IRA, including the advantages of adding gold to accounts for retirement savings, different kinds of gold bullion and the types of coins which are permitted within the Gold IRA, the steps to setup an Gold IRA rollover, and numerous other. If you're an experienced investor or are just beginning to get started with investing in precious metals this gold IRA Rollover guide will assist you to make educated decisions in protecting your investments with gold. What is a Gold IRA Rollover? An rollover of gold IRA rolling over is the

Content #3 American Hartford Gold: Best Gold Buyback Program Step Two: Start Your 401k Rollingover You Can Convert Your Retirement Plan To Gold With An Ira Rollingover What Is A "gold Ira Rollover"? Even if your company's 401k plan doesn’t allow you to withdraw or transfer funds, you might still be able for such a transfer. Most 401k plans offer a "hardship withdraw" exception. This allows your plan administrator to disburse funds as long you are willing to help. The plan administrator can grant such an exception, but it is almost always at his discretion. This means that you're the only person responsible for choosing the investments in your account. These SDIRAs can also be Roth- or Traditional-based, depending on which type you choose. Physical gold is a great asset to your portfolio, especially for retirement savings. Personal precious metals, such as bullion, gold and silver bars, will be readily available. They can also be stored in an IRS-approved safe deposit box. You can then deposit some or all the money into a Precious-metals IRA account. This guide will briefly explain how a 401 from a former employer could be rolled-over into a gold IRA or silver

Content Investing In Gold With A Retirement Plan (401(k)) How To Open A Gold Ira Choose From Approved Gold And Silver For Ira Investing Rainbow Mountain, Peru: The Ultimate Vinicunca Explorer's Guide Why Can't I Exchange Physical Gold With A Retirement Program? Real Estate Investing Offers Many Advantages Can I Transfer Or Do A Rollover Of A 401k Into A Gold Ira? The account holder is a simple, straightforward process that is managed by the top custodians. You can also ask about shipping 401k to gold for precious metals like silver and gold, and insurance coverage for the journey. A precious-metals IRA might be the right choice for you if you are looking for a safe and secure investment option for retirement. It doesn't really matter how long it takes for you to retire. But it's never too soon to start planning your retirement and investing. Alternate to changing jobs, you might be able take out a loan against your 401. While 401 accounts can be a great way to reduce taxes and increase your retirement savings potential, they are often limited in terms of investment options. This allows them to maximize potential profits and expand their investment.

Content Can I Buy Physical Precious Metals Using My 401k Funds Get Up To $10,000 In Silver Free Of Charge Q: What Precious Metals Can I Invest In With A Gold Ira? #4 Birch Gold Group: Offers A Wide Range Precious Metal Options Biden is now ordering more money than ever before to fund his stimulus packages, and infrastructure plans. The IRS warns that taxpayers who do this run the risk of engaging with a prohibited transaction, among other problems. They could then owe income 401k to gold ira es on the entire IRA balance and a tax penalty if their age is younger than 59 1/2. There are many trusted Gold IRA companies that you can trust with your investment. As we have already mentioned, American Hartford Gold, Goldco and Augusta Precious Metals are some of the top Gold IRA companies. To make gold IRAs safer, most gold sellers take advantage of the difference in volatility between gold and the stock or paper currency markets. Contributions to a retirement account are defined and received from the employee's pretax paycheck. American Hartford Gold is a Gold IRA Company that can help you Can I Buy Physical Precious

Are you considering securing the retirement funds you have saved from fluctuations? If so, you may think about rolling over your 401k savings to an gold IRA. In this blog we'll talk about how to make the switch and how you can benefit from purchasing gold. Introduction to Gold IRA Rollover It is vital to grasp the fundamentals of IRA rollover prior to taking the decision to move funds from the 401(k) into the gold IRA. An gold IRA is a retirement account that allows customers to put money into physical silver, gold, and different precious metals. This type of retirement account offers many advantages, including tax-deferred investment potential, as well as the opportunity for diversification of your investment portfolio through an actual asset. To initiate the 401(k) for gold IRA rollover, it is necessary to first open an account at a custodian that specializes in investments made with gold. Once you have an account, you can contact the organization that manages your 401(k) to start the transfer process. It is important to know that some 401(k) plans do not allow direct investments into physical precious metals, so it is vital to speak with the plan administrator before

Think Twice Before Opening A Gold Or Silver Ira With a gold IRA rollover, investors can minimize their tax exposure since distributions are normally subject to ordinary income tax rates. This can lead to gold in an IRA being subject to a lower tax rate, especially for those with lower income tax brackets. Those who invest in a Roth-gold IRA will not be taxed on any gains from their gold investments. Read more about 401K to Gold IRA Rollovers What is a Gold IRA? However, in a direct IRA rolling over, the savings can be moved directly from one account into another. You need to decide between a direct and indirect rollover. You can request an indirect rollover by asking for the withdrawal of funds from one bank account and depositing them into another. Are Precious Metals Becoming More Popular? This company is different from other gold IRA companies because it has many unique features. The firm offers a lifetime warranty and a large range of educational materials. Only a handful of companies are authorized to include certain cryptocurrency investments in an IRA.