Traditional vs. Roth vs. SEP IRA: Differences?

Last updated: may 5, 2023 at 11:04 am

when it comes to saving for retirement, there’s no one-size-fits-all solution. Instead, we have many options in today’s world, each with unique features and benefits.

Two popular choices among these are simplified employee pension (sep) iras and roth iras. As you plan for your financial future, it’s essential to understand the differences between these two retirement savings vehicles and determine which one best suits your needs. In this comparison, we’ll compare sep and roth iras, discussing their advantages, limitations, and eligibility requirements to help you make an informed decision.

Two popular choices among these are simplified employee pension (sep) iras and roth iras. As you plan for your financial future, it’s essential to understand the differences between these two retirement savings vehicles and determine which one best suits your needs. In this comparison, we’ll compare sep and roth iras, discussing their advantages, limitations, and eligibility requirements to help you make an informed decision.

Both roth and traditional iras come with contribution limits set by the irs for retirement plans. From 2021, the maximum annual contribution to a plan for the majority of individuals will be $6,600 (or $7,000 for those who are 50 or over). These contributions are essential to build retirement savings and to avoid excessive contributions. The other hand, sep iras allow greater retirement plan contributions limitations determined by business income. Businesses can give up to 25% of salary of $58,000 (whichever lower) in 2021 to their retirement savings. http://y1e.s3-website.ap-northeast-1.amazonaws.com/401kgoldira/Retirement-Plans/Choosing-a-SEP-IRA-or-Roth-IRA-in-2023.html

Traditional vs. Roth vs. SEP IRA: An Overview

Officially, an ira is defined as an individual retirement arrangement by the u. S. Internal revenue service (irs). Generally, people refer to it as an individual retirement account. An ira offers investors a tax-deferred way to build the value of their investments during their working years. Traditional iras, roth iras, and sep iras are three types of individual retirement accounts. In some ways, they're similar. Yet, there are some key differences in how they work, which can make one type better than another, depending on your goals and tax situation.

This article provides the basics for all three iras to help investors get started on their retirement savings journeys.

This article provides the basics for all three iras to help investors get started on their retirement savings journeys.

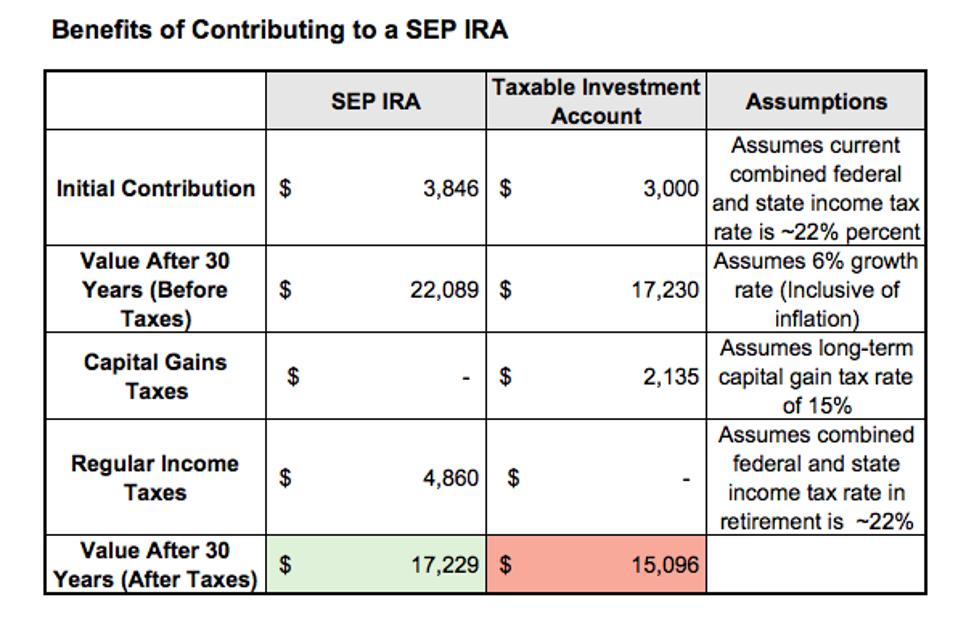

A sep-ira is a traditional ira that holds contributions made by an employer under a sep plan. You can both receive employer contributions to a sep-ira and make regular, annual contributions to a traditional or roth ira. Employer contributions made under a sep plan do not affect the amount you can contribute to an ira on your own behalf. Because a sep-ira is a traditional ira, you may be able to make regular, annual ira contributions to this ira, rather than opening a separate ira account. However, any dollars you contribute to the sep-ira will reduce the amount you can contribute to other iras, including roth iras, for the year.

How Does the Tax Break Work for a Traditional IRA?

A sep ira is a tax-advantaged retirement plan designed for business owners, contractors and self-employed workers. It shares some similarities with standard iras. But sep iras may have higher contribution limits and different eligibility requirements. In 2023, traditional iras and roth iras have a $6,500 contribution limit. Account holders 50 and over can make an additional $1,000 catch-up contribution. For the same year, sep ira participants could invest the lesser of $66,000 or up to 25% of the first $330,000 they earn. Traditional ira and roth ira contributions are made by the account holder. But sep iras are funded with employer-only contributions.

So, you’re killing it as your own boss, or you’re part of the backbone of the american economy working at a small business. You’ve got your business or career plan in place—but what about your retirement plan? are there options out there for you? don’t worry, there are—and one you’ll want to know about is the sep ira. That stands for simplified employee pension individual retirement account, and it lets self-employed folks and small businesses create retirement savings plans that are tax-deferred accounts and work like traditional iras. This opens up an option for companies with small teams—or a team of one—who likely wouldn’t be able to offer other types of retirement plans because of the complicated setup and high administrative costs.

A simplified employee pension (sep) ira is a retirement account designed for small business owners and self-employed people. Any business owner with one or more employees, or any self-employed person (e. G. , a freelancer), can open a sep ira. These accounts are simple to set up and have low administrative costs. The first step for someone who wants to set up a sep ira is to pick a trustee (e. G. , a financial institution) to hold the retirement plan assets. If you’re a business owner with employees, the trustee will set up a separate account for each eligible worker.

Sep stands for simplified employee pension, and this plan is available for employers, including the self-employed. Employers can avoid the complex reporting requirements that the government usually mandates for retirement plans. With a sep ira , only the employer makes contributions to the account. Employers may contribute up to 25 percent of an employee’s pay annually to the account, up to a total contribution of $61,000 for 2022 and $66,000 for 2023. The employer must contribute an equal percentage for all employees, though it may exclude some who have retirement plans through a union agreement. The employee is immediately 100 percent vested in all sep ira contributions and has full control of the money.